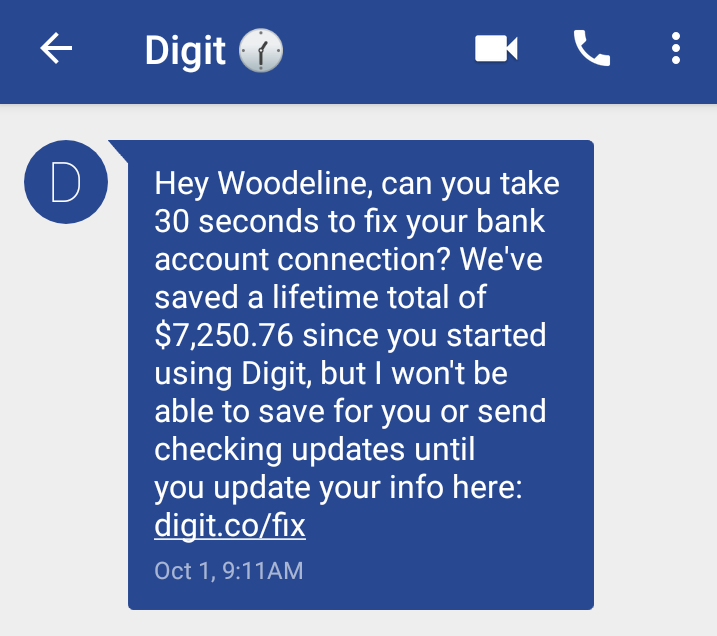

How I Saved Over 7K With This One App

Who doesn’t like saving?

Shortly after I pass my nursing exam, with almost no money, no family, but a job; I had got a one way ticket from Miami to Philadelphia.

I started working within a week, since I had a temporary placement for the first two months, I had enough time to look for a much permanent apartment. And, you all know an apartment comes with down payment, first and last month of rent, furniture, electricity set up etc…Thank God, I had my little side hustle to cover a few bills but it wasn’t much.

Now that my saving almost gone, I had to find a way to save faster and smarter. One day, I remember seeing a post on Facebook about Digit, just what I needed and I gave it a try. I set up my Digit account, connect it to my bank, created different money goals for different categories and the money was taken from my bank account every per pay period or after every purchase.

Yesss, I have a saving account with my bank, but the fact that it’s readily available, it was easy for me to make a few transfers and I wasn’t really saving much doing that. Therefore, having an online saving without a physical card or easy transfer was very beneficial.

WHAT IS DIGIT AND HOW DOES IT WORK?

Digit is a saving tool that does the thinking and acting of saving money for you without noticing. You simply connect your Digit to your bank account; then the app takes a look at your current funds and puts aside some money in an FDIC-insured Digit account.

When you sign up for Digit, you can create monthly and yearly goals. For instance: Birthdays, Emergency Saving, Rainy Days, Business Expenses and Self Care. Digit will determine if you can’t spare any money and won’t withdraw anything from your bank account. It will even send you a text message saying:” Due to low balance, it will not take any money”. The app is free for only 100 days, then becomes $2.99 a month. In addition, It gives you the ability to earn one percent savings bonus that is paid every three months. Let’s say you have an emergency; Digit can automatically transfer back to your checking account whenever it gets below a certain amount or you can text “withdraw” and the amount you choose to withdraw will go back to your bank account.

The good thing is, if you feel like your monthly income for the month is less than usual or may have unexpected emergencies, you can pause and restart the saving app whenever necessary. You also get money for referring your friends.

Last year, I literally saved all the money to launch my “Dedication Planner” which is a life planner to help healthcare professionals and female entrepreneurs prioritize life goals with proper planning. I also was unemployed for more than two months after leaving my job in Philly to move to Atlanta. With my regular saving account and the one on Digit, I was able to cover two months worth of rent, movers and getting a new place in a whole new state.

Are you considering getting DIGIT? I strongly recommend it because it fits every budget and will make saving so much easier. I suggest you to give a try. Get access here: Digit

Are you in need of a planner with a saving tracker that helps you manage your different saving account? Stay in touch and get all the details about the upcoming 2021 Dedication Planner. here